Tax Impact and Financial Information

Homeowners Over 65

-

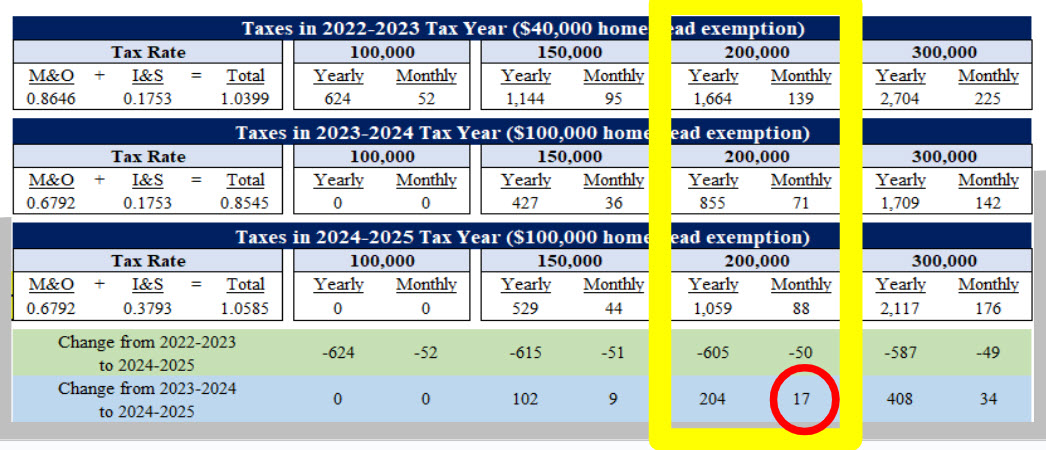

Homeowners over the age of 65 who have filed their Homestead Exemption with the appraisal district will not see an increase in property taxes associated with this bond.

Tax Impact Calculator

-

Onalaska ISD does not set property values, only the school district tax rate. The Polk Central Appraisal District determines property values.

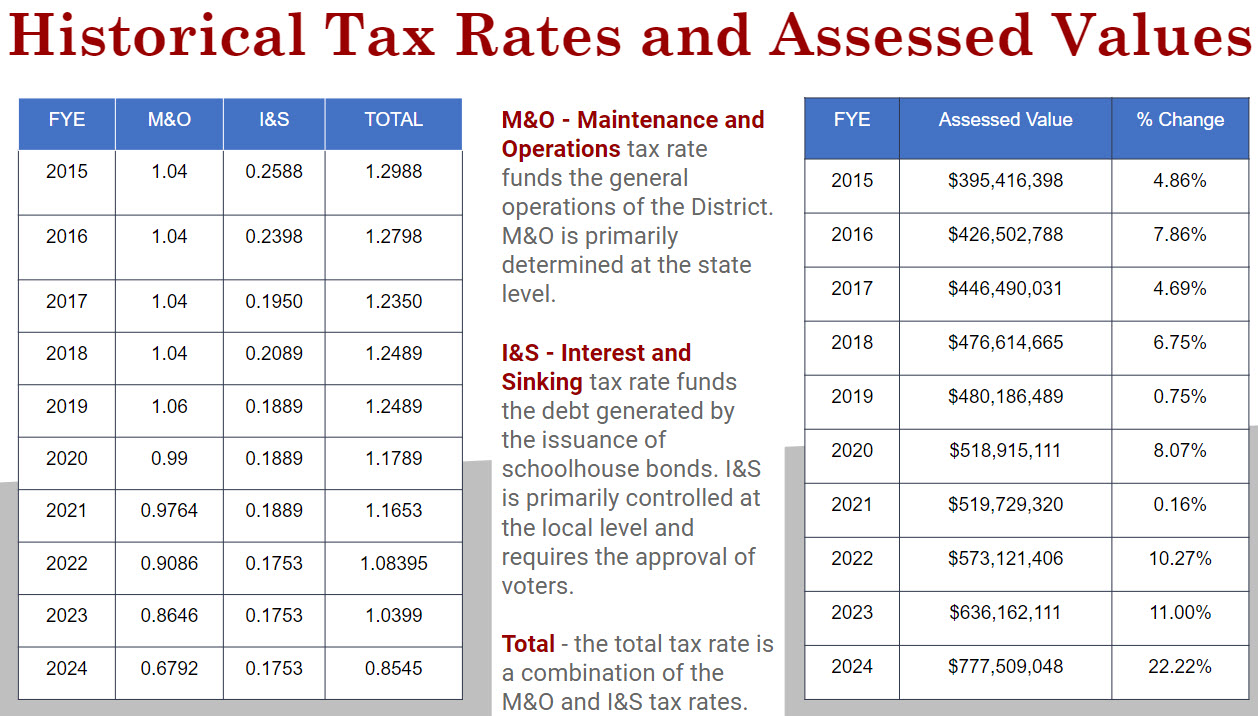

Tax Rate History

The average home in OISD is valued at $228,000. The projected increase after the bond for that household would amount to $22 dollars a month. Any homesteaded house valued at $100,000 will not pay any school taxes.

What specifically do we do with M&O / I&S

-

Maintenance & Operations (M&O) Rate

Funds the daily operations or recurring costs of the district:

-

Staff salaries

-

School supplies/materials

-

Bus repairs/maintenance/fuel

-

Utilities

Interest & Sinking (I&S) Rate

Used to pay annual debt payments approved by voters through bond elections:

-

New building construction

-

Existing building renovations

-

-